Board of Assessment Review

The real property tax is an ad valorem tax (that is, a tax levied on the basis of value). In the first instance, it is the local assessor who determines the taxable value of real property. As you may be aware, New York State Law requires all properties to be assessed at a uniform percentage of value each year.

Taxpayers who feel their assessments are unequal, excessive, unlawful or that their property is misclassified, have a right to have their assessments reviewed by the Board of Assessment Review, or if necessary, by the courts

-

Michael Tracy

phone: (518) 582-4851

-

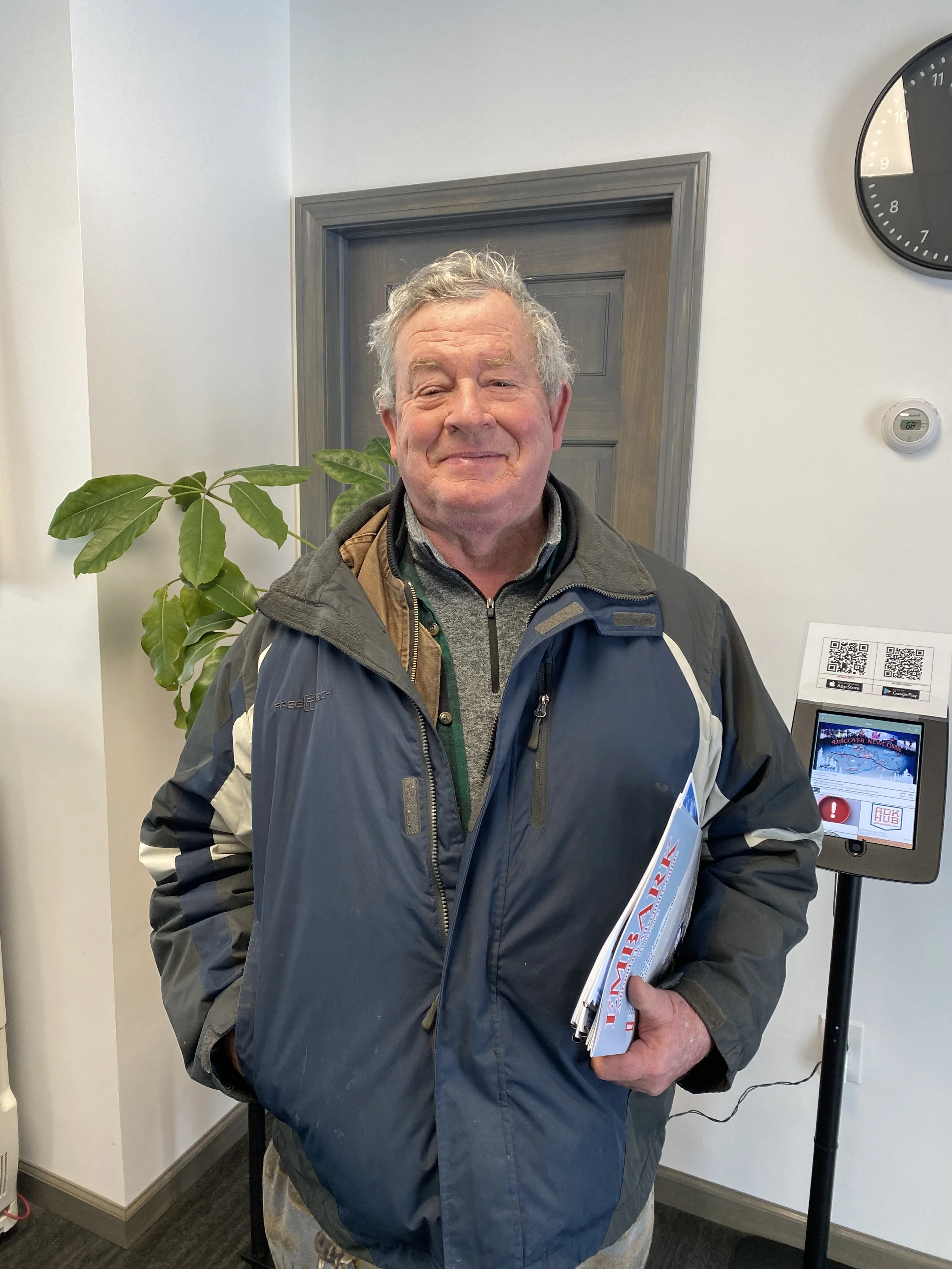

Drew Cullen

-

Raymond Wood